bKash Loan from City Bank: 7 Easy Steps to Get Fast

The highly popular mobile financial company, bKash, has initiated a ‘bKash Loan‘ distribution program to its customers in collaboration with CityBank Bangladesh Limited. In this overview, I will provide comprehensive information about the bKash Loan by CityBank, including the application process for the bKash and CityBank Nano Loan, as well as guidelines on repaying installments.

City Bank Bangladesh and bKash have officially launched the Digital Nano Loan following a successful pilot program. Upon receiving the loan, bKash customers are required to make three easy EMI payments. This initiative marks Bangladesh’s entry into a digital, paperless, and instant loan system.

The BanglaDocs Finance team consistently monitors the bKash and City Bank loan distribution methods and implements necessary updates in real-time. Through this approach, I am pleased to provide you with the latest update as of August 2023.

Contents

Mobile loan in Bangladesh

Recently, the Central Bank of Bangladesh has introduced a Mobile Digital Loan Distribution scheme to provide urgent personal loans to the people of Bangladesh. A total of 100 crore BDT will be distributed through Mobile Financial Services (MFS)

Genuine Bangladeshi citizens can avail loans of up to fifty thousand Taka bKash Loan at a 9% interest rate. This entire amount will be disbursed through the Mobile Banking Loan Application Process.

bKash Loan

City Bank and bKash have introduced the Digital Nano Loan for Bangladeshis. Eligible bKash customers can apply anytime and anywhere using their bKash App. The automated loan processing system will assess the loan amount using City Bank loan calculator.

Once the loan amount is determined, the bKash customer will receive the funds directly into their bKash account, ensuring a seamless and convenient experience.

This collaborative effort between City Bank and bKash not only simplifies the loan application process but also extends financial assistance to those in need, promoting greater financial inclusion and accessibility for individuals across Bangladesh.

You can check our Security Code Recovery guide for XI Class Admission. Hope it will helpful for college admission in Bangladesh.

City Bank bKash Loan

While financial service providers have been offering various facilities such as transactions, mobile recharges, and merchant payments, the sector has felt somewhat incomplete due to the absence of loan services.

City Bank Bangladesh has stepped in to fulfill the demand for mobile loans in Bangladesh through the bKash Mobile financial service. With this initiative, Bangladesh has ushered in the era of ‘online loans in Bangladesh’, addressing a previously unmet need in the market.

Applicants do not require a bank account to apply for this ‘online loan bd’. bKash users can directly apply for the ‘City Bank bank loan’ through the bKash App.

Moreover, they are not obligated to visit a bank branch to receive the approved loan amount; instead, the loaned funds will be directly deposited into their mobile apps. Subsequent installment payments can also be conveniently made through the same platform.

Note: No collateral will be necessary for this loan, and there will be no need for a guarantor or nominee. This approach is expected to facilitate the growth of the business sector.

Eligibility to Apply bKash City Bank Digital Nano Loan

At present, every bKash customer has the opportunity to apply for the City Bank Digital Nano Loan. To begin with, every bKash user must update their account by fulfilling the eKYC requirements.

According to the Mobile Loan distribution regulations in Bangladesh, only customers who have completed biometric e-KYC and have been using this service for an extended period are eligible to apply for this loan.

Individuals who have recently opened a bKash account through the biometric process or have been using the service for a short duration are not eligible to apply.

Therefore, it is advisable to use your bKash service consistently over a longer period in order to become eligible for the loan.

Requirements to Apply for bKash Loan

1. bKash users who have completed eKYC and opened their accounts via the Biometric System.

2. Substantial experience using bKash over an extended period.

3. Consistent engagement in quality transactions.

Both bKash and City Bank’s AI systems will analyze users’ transactions, behaviors, and usage history. Therefore, those who adhere to proper usage guidelines will have a greater likelihood of securing a loan from bKash.

Steps for taking loans in bKash

I will guide you through the process of submitting an online loan application with City Bank via bKash, receiving the loan amount, and making EMI payments. Simply follow the steps outlined below to avail your mobile loan today.

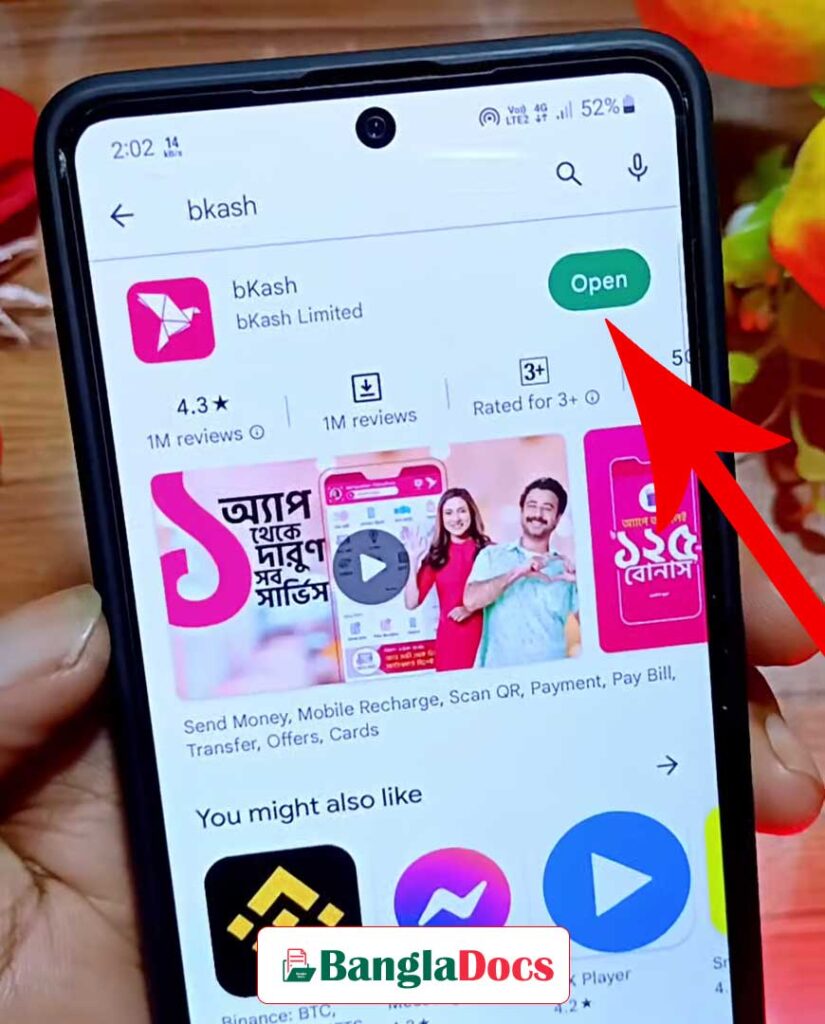

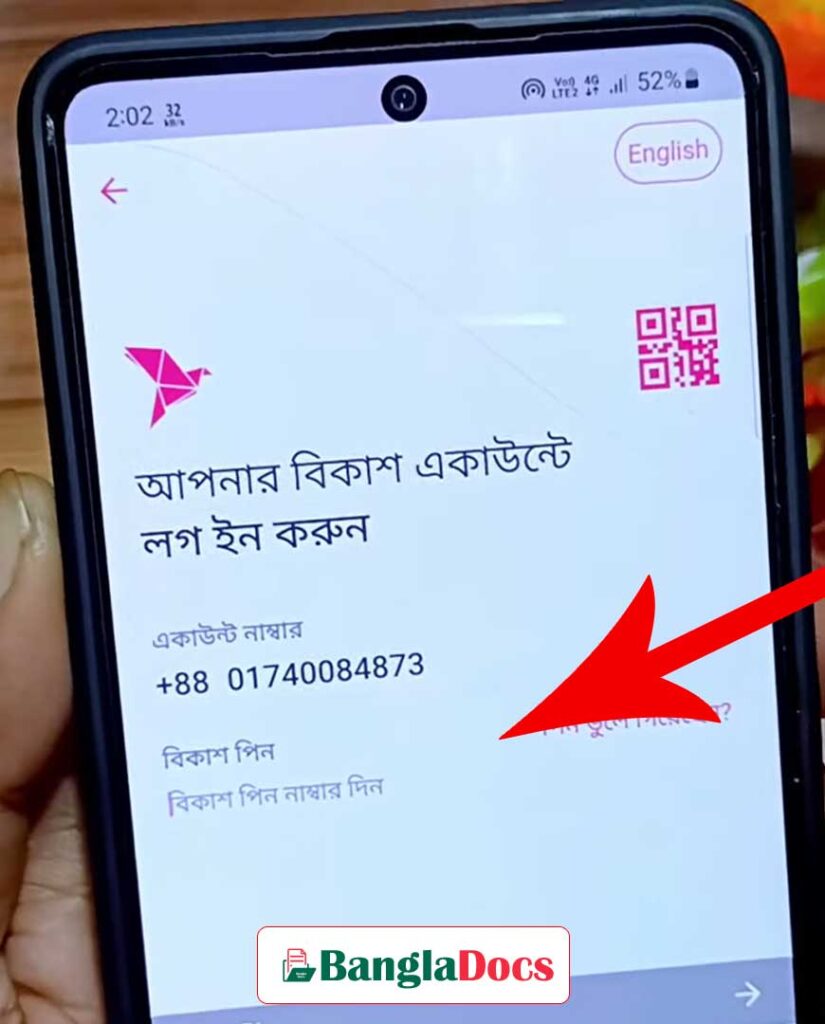

1. Open your bKash App.

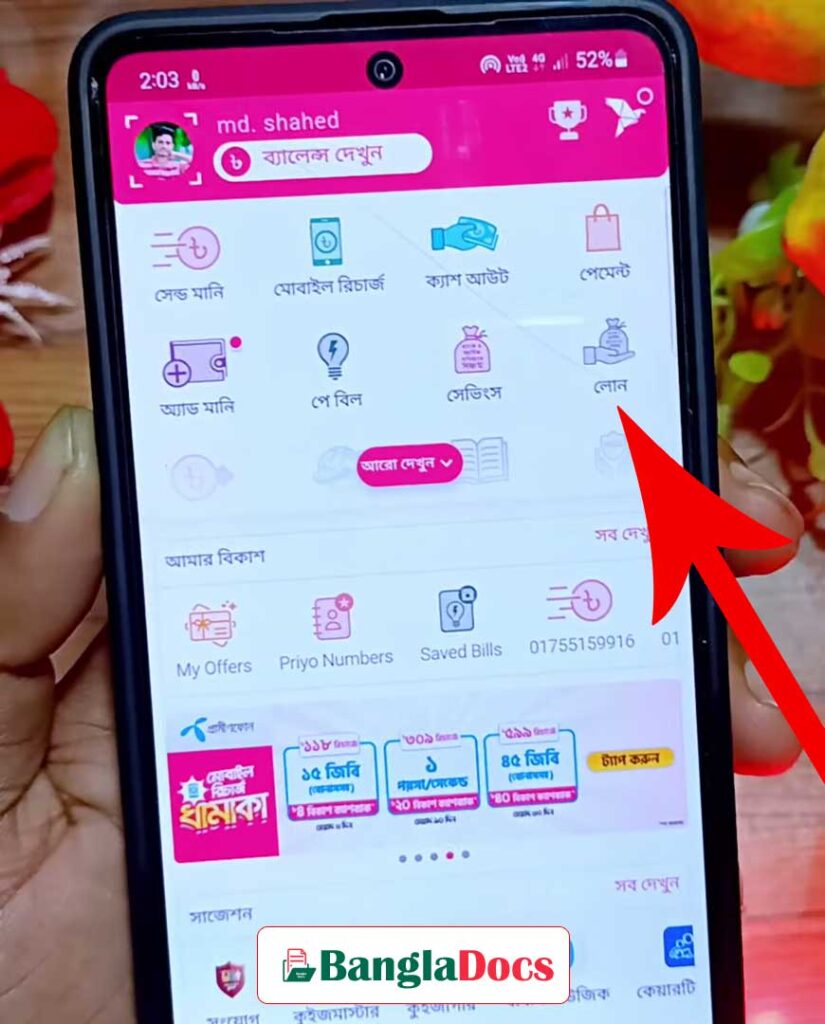

2. Tap on the ‘Loan’ Icon.

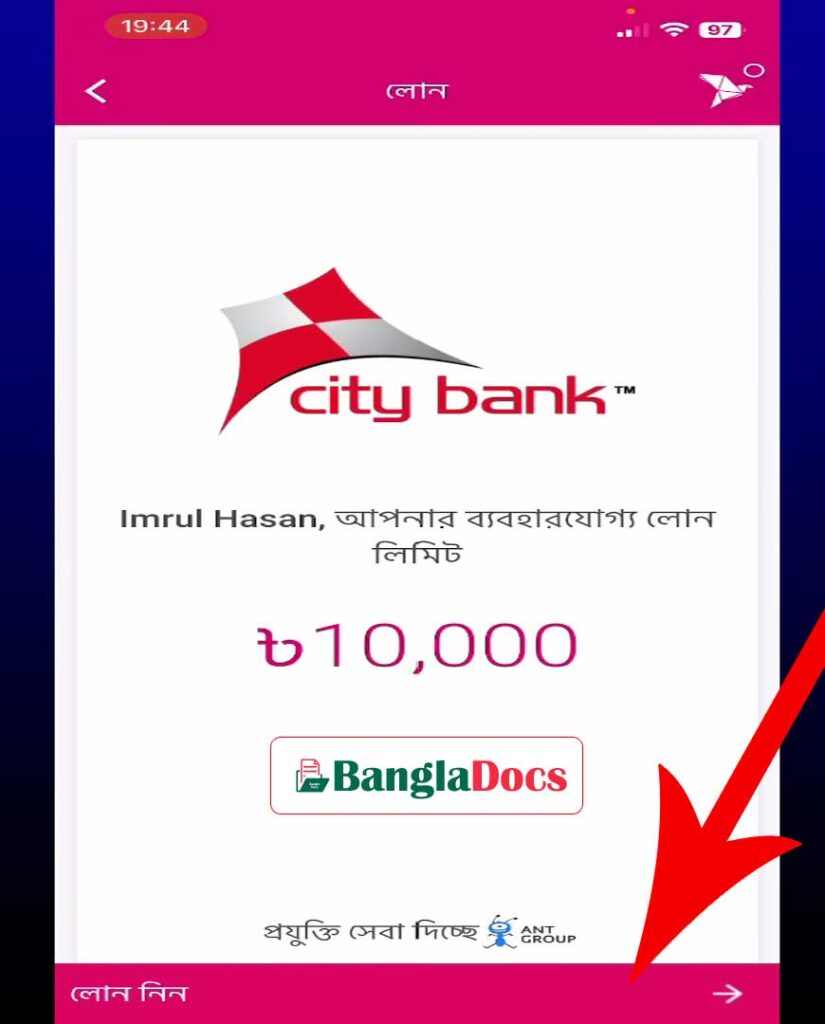

3. bKash will analyze your history and display your Loan Usage limit. Click the ‘Take Loan’ button.

4. The system will present the loan payment schedule. After reviewing this, tap the ‘Go Forward’ button.

At this stage, bKash will provide details about the issuing bank, monthly loan payment dates, the approved loan amount, loan processing fees, the final amount you will receive, and the installment payment plan. It will also outline the total interest to be paid, interest rate, monthly payment schedules, and EMI amounts.

5. Double-check all information and tap ‘Agree and Go Forward’.

An important message containing bKash loan-related guidelines will appear. Read these carefully before proceeding.

6. Enter your bKash PIN and tap ‘Confirm’.

7. Verify the loan data once again and ‘Tap & Hold’ for 10 seconds.

Your bKash Mobile City Bank Personal Loan amount will be deposited into your bKash Account. A confirmation window will appear, and an SMS will be sent to your mobile number. Simply check your balance and enjoy the funds.

Note: It’s crucial to stay up to date with bKash Loan EMI or installment payments. Their highly trained AI system could potentially restrict your access to further tasks if payments are neglected.

bKash Loan Installment Payment

bKash will apply a 9% interest rate to your loaned amount, in accordance with the regulations set by the Bangladesh Bank Loan Rules. The installment amount will be automatically debited from your account.

Users are required to maintain the necessary funds in their account every month. Prior to deducting the installment, the system will send a notification SMS.

For the next three months following the loan disbursement, City Bank will deduct the same amount as the loaned sum from your account. The bKash system is designed to handle this process, and its AI will monitor whether payments are made punctually.

City Bank bKash Loan Information

| Description | Amount or Information |

| Loan amount | 500 BDT to 20,000 BDT |

| Period of Time | Maximum Three Months |

| Interest Rate | 9% Yearly |

| Interest Count | Daily |

| Loan Processing Fee | 0.575% (with VAT) |

| Late Fee | Yearly 2% |

Watch the Official Video Before Apply for bKash Loan

Some important FAQ’s About bKash CityBank Mobile Loan

Q: How may I get bKash loan?

Ans: Just open your bKash App. Login by Enter your account number and PIN. Tap on ‘Loan’ icon to request bKash loan.

Q: How much loan I can receive from bKash?

Ans: bKash and City Banks AI will analyze your using history to find how much loan you can get. According to limit you can avail 500 BDT to 20000 BDT at this time.

Q: How much Interest have to pay for bKash loan?

Ans: As per Bangladesh Bank Mobile loan guideline City Bank will apply 9% yearly interest on your loaned amount.

Q: What is the bKash and City Bank loan payment validity?

Ans: bKash digital loan payment time is maximum three month. You have to pay three same installment every months.

Hope this article help you to get City Bank and bKash Digital loan easily and instantly. If you benefited by following our guide just share with friends and family.

BanglaDocs Financial Editor

5 Comments